Credit balances occur when a healthcare provider receives payments exceeding the amount owed for services rendered. These overpayments can come from insurance payers, patients, or coordination of benefits issues. Managing credit balances properly is critical for compliance and financial health. Professional Credit Balance Services help healthcare organizations resolve overpayments efficiently and accurately.

What Are Credit Balance Services?

Credit Balance Services focus on identifying, researching, and resolving credit balances in patient accounts. This includes analyzing payment discrepancies, coordinating with payers, processing refunds, and maintaining compliance with federal and state regulations.

Failure to resolve credit balances can lead to compliance risks, payer audits, and financial penalties. Specialized services ensure that overpayments are handled promptly and correctly.

Common Causes of Credit Balances

Duplicate payments

Overpayments from insurance companies

Incorrect patient payments

Coordination of benefits errors

Coding or charge entry mistakes

Contractual adjustment issues

Key Components of Credit Balance Services

1. Credit Balance Identification Billing experts review patient accounts to identify credit balances across insurance and patient responsibility accounts.

2. Root Cause Analysis Each credit balance is analyzed to determine the cause of overpayment and the responsible payer or patient.

3. Payer & Patient Communication Clear communication with insurance companies and patients ensures accurate resolution and proper documentation.

4. Refund Processing Timely processing of refunds in accordance with payer contracts and regulatory requirements.

5. Compliance & Audit Readiness Credit Balance Services help providers remain compliant with CMS guidelines, HIPAA regulations, and payer policies, reducing audit risks.

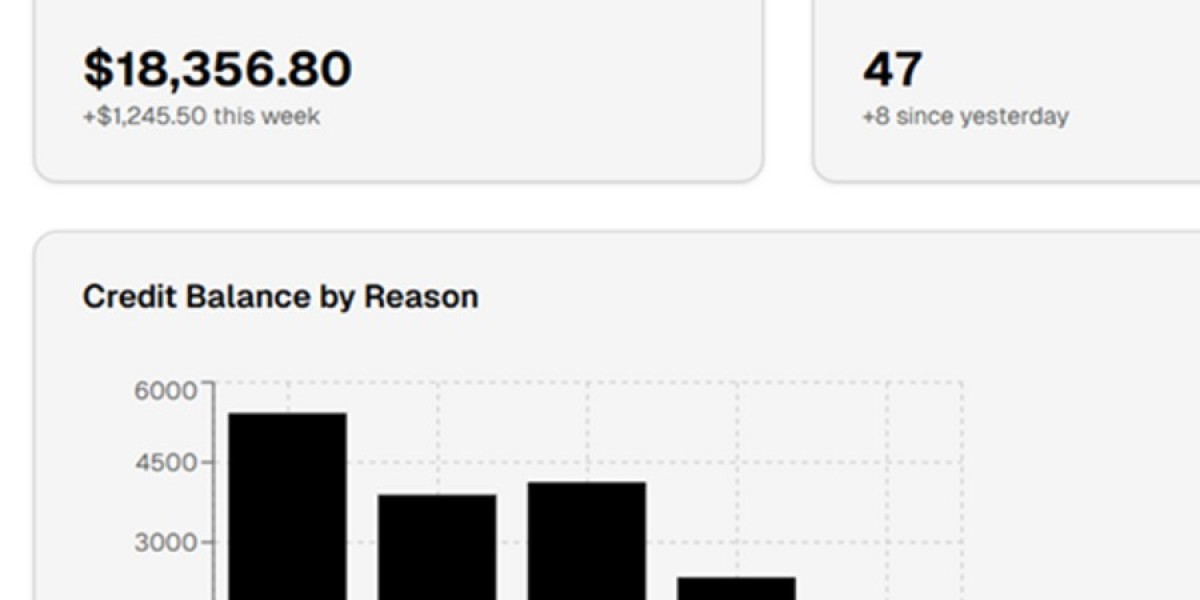

6. Reporting & Documentation Detailed reports provide transparency into resolved and outstanding credit balances.

Who Needs Credit Balance Services?

Hospitals

Physician Practices

Behavioral Health Clinics

Specialty Clinics

Ambulatory Surgery Centers

Any healthcare organization processing insurance and patient payments can benefit from professional credit balance management.

Benefits of Outsourcing Credit Balance Services

Reduced compliance risks

Improved financial accuracy

Faster resolution of overpayments

Protection against payer audits

Better patient satisfaction

Credit Balance Compliance Risks

Unresolved credit balances can result in penalties, repayment demands, and reputational damage. Proper management ensures ethical billing practices and financial transparency.

Why Choose Professional Credit Balance Services?

Experienced credit balance teams understand payer contracts, refund timelines, and regulatory requirements. Outsourcing ensures consistent, compliant, and efficient overpayment resolution.

Conclusion

Credit Balance Services are essential for maintaining compliance and financial integrity in healthcare organizations. With expert management, providers can reduce risk, improve accuracy, and ensure responsible handling of overpayments.